Cannabis Payment Processing Solutions For Your Dispensary

As a dispensary owner, you want to provide the best shopping experience to your cannabis customers. You work hard to educate your budtenders about various strains. You search out the best-quality products and make your cannabis space an inviting place where cannabis consumers and employees want to spend their time.

But you can’t do all of this without getting paid.

The Changing Landscape of Cannabis Payments

Payment processing regulations for cannabis businesses seem to be constantly in flux. Due to the federally illegal status of cannabis products in the U.S., cannabis payment processing options are already more limited than in other industries, but recent developments have made the situation even more complicated.

So in order to stay in business, you need to be up to date on the latest developments in cannabis payment options.

Read this guide to stay informed about the changing options for payment solutions or click here to request a demo of Springbig’s payment solutions today!

Can Cannabis Businesses Accept Credit Cards and Debit Cards?

As you’re probably aware, dispensaries are unfortunately barred by credit card processors from accepting credit cards and debit cards for cannabis transactions. Major financial institutions, traditional banking services, and large credit card processing companies like MasterCard, American Express, and Visa do not allow cannabis businesses to use their payment solutions.

Cannabis credit card processing just isn’t an option (although some businesses have tried to brainstorm workarounds with limited success, and these workarounds are usually still in violation of network rules).

This means that customers are also prohibited from using debit cards at cannabis dispensaries, as they operate on the same networks – with the same network rules.

We don’t expect the situation to change unless there is federal legalization. And as of this writing, there aren’t any plans for cannabis legalization in the U.S.

Cannabis Payments and Cash – Pros and Cons

These days, many customers no longer carry cash. They prefer the convenience of PayPal, Zelle and Venmo, and they easily double-click on their Apple Wallet.

These payment options aren’t available for cannabis payment processing, so most cannabis dispensaries have traditionally focused on cash.

But while some cannabis retailers opt to rent or buy ATM machines, the cash payment method has many drawbacks.

The Disadvantages of Cash Payments

Some customers don’t feel comfortable performing ATM transactions in crowded areas, because others can see them inputting their personal identification number

Others don’t like to handle cash, especially during the high-risk COVID era

Many customers lament the additional fees of an ATM transaction

ATM’s discourage impulse purchases. Let’s say a customer has withdrawn just enough money to make a purchase, but then another product catches their eye. They probably won’t want to go through the inconvenience of making another transaction

Customers apparently spend less when they use cash

The use of cash doesn’t tend to promote a seamless customer experience

With cash handling, there’s always a human error factor

Customers tend to equate digital payments with secure payments

Cash Management as an Operational Expense

Dispensaries that deal with cash need to invest in heightened security measures to protect both the cash and the safety of customers and employees

Oftentimes, dispensaries will need to pay third parties for cash handling fees

Record keeping and compliance are more difficult to track with payments in cash, forcing dispensaries to hire additional personnel or invest in resources for regulatory purposes

Unsustainable Cashless Payment Solutions

Over the year, cannabis dispensaries and other high risk merchant accounts have used different methods to avoid the inconveniences and human error of cash payments. In some cases, they have tried to offer credit card payments, disguising their accounts under another company name.

As you can imagine, this technique may arouse the ire of regulators.

An Old Workaround: The Point of Banking, or Cashless ATM Method

As an alternative to cash management, many cannabis dispensaries have operated what are known as “cashless ATM’s,” also called “point of banking.”

With this payment method, the point-of-sale device assumes the role of an ATM machine, withdrawing directly from a customer’s bank account. Dispensary purchases are treated like traditional ATM transactions, except they deposit cash into the dispensary’s account instead of the customer’s hands.

Amounts are billed in typical ATM increments of $5, $10, or $20, just like at an actual ATM.

A Gray Area in Cannabis Banking Solutions

Unfortunately, the U.S. banking system does not look kindly on this payment solution. It comes dangerously close to PIN debit card payments, which are obviously not allowed.

And in some cases, unscrupulous cannabis companies have disguised transactions to appear as though they are coming from adjacent businesses. This practice should obviously be discouraged.

Dispensary Customers and Bank Account Scams

Another possible reason for the strict regulations surrounding cannabis transactions is the proliferation of scams involving fake marijuana dispensaries. Some of these sham companies advertise that they accept payments via credit card or debit card.

Most customers are probably unaware of the federal laws regarding cannabis payments, so they might be easily fooled by one of these phony companies.

According to the Better Business Bureau, one increasingly common scam has customers making payments via digital wallets which enable payment methods like CashApp. In this scheme, a person pretending to be a dispensary employee will demand a few hundred dollars for “fees.”

Of course, once a customer makes that transfer, their money is gone forever.

Point of Banking Transactions: The Plot Thickens for the Cannabis Industry

In late 2021, Visa issued a warning to banks that facilitated cashless ATM transactions, maintaining that point-of-sale devices were operating in violation of their rules.

The Visa payment system did not want to be involved with any activity that could potentially be federally illegal. So it basically threatened to kick associated banks out of its network.

And now it seems that push is coming to shove.

Is It Over for Cashless Payments?

Bloomberg reports that point of banking transactions are now experiencing major outages, and the whole system may be poised for a total shutdown. With the recent instability in cannabis stocks, it’s a bad time for this to happen to the cannabis industry.

But cash continues to pose problems not only for dispensary customers, but for dispensaries themselves – especially in the realm of security.

Security Risks and Cash Payments

According to American Marijuana, dispensary burglaries are occurring with frequency. One city in Washington experienced five of them in a week.

The publication reports that while burglars sometimes target cannabis products, they mostly aim to leave with as much cash as they can.

The Safe Banking Act Snafu

Recognizing that cannabis retailers are in a bind, legislators have proposed the the Secure and Fair Enforcement Banking Act (SAFE). The measure would prohibit regulators from punishing banks for doing business with cannabis businesses. It also would provide important liability protections for financial institutions.

But the Senate refused a hearing on the measure in December 2022.

Some legislators want to try to advance the bill again this year, but the chairman of the House Financial Services Committee has indicated that he is personally opposed to this idea.

Alternative Payments Options for the Cannabis Industry

Happily, you have an alternative if you want to avoid the inconvenience and security risk of cash handling and the hoops you have to jump through to get a cannabis merchant account with a traditional payment processor.

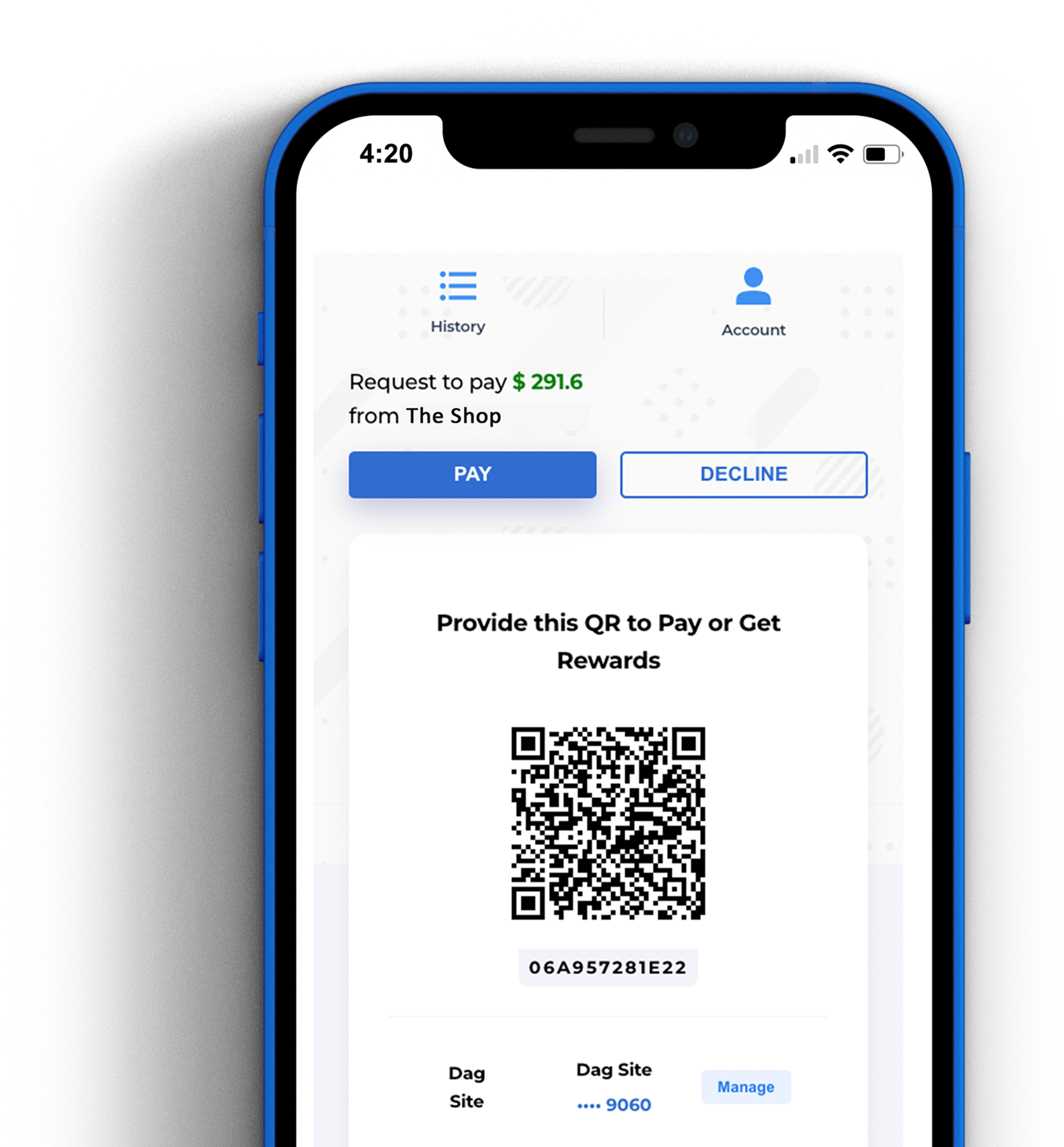

Springbig has partnered with industry’s leading cannabis payment processor, Spence. Spence’s secure payments platform allows customers to make electronic payments in advance, or in person using their mobile device.

Spence’s payment processing platform can be embedded directly into your website for easy online payments and even integrate with Springbig’s rewards app enabling dispensaries to accept payments using customer loyalty points!

It’s similar to the streamlined experience of using the Starbucks app – only it’s for cannabis and can be used in your dispensary.

Spence takes on the high risk of cashless payments and provides dispensaries secure digital payment options without the high processing costs of other cannabis payment providers on the market.

With Spence, customers benefit from the convenience of digital payments and can even make purchases in advance using the Enjoy Now, Pay Later function.

Better yet, Spence’s cannabis payments platform can be white-labeled to ensure a consistent brand image across the entire transaction funnel.

Advantages of Using a Digital Payments Processor

Compliant cannabis payment processors offer many attractive features:

They can incorporate your logo and QR code into their payment platforms, creating an integrated brand environment for your customers

They facilitate a reduction in cash payments, and encourage more secure payments

They can integrate with your loyalty program, even letting customers use their loyalty points as currency

Will Cannabis Always Be Federally Illegal?

A couple years ago, Supreme Court Justice Clarence Thomas opined that federal marijuana laws might be unnecessary. He seemed to lament the U.S. government’s “piecemeal approach” to cannabis law. Naturally, his comments caused quite a buzz.

People have been speculating for years about when marijuana might be federally legal. As far back as 2014, the former governor of New Mexico claimed that 2024 would be the magic year for the cannabis industry.

However, all of this has not translated into any new legal developments (or any other type of buzz). The cannabis payment processing sphere remains up in the air.

Looking Towards the Future of the Cannabis Space

While we wait for the U.S. government to have a change of heart, digital payment processing companies are preparing their credit card processing capabilities for the lucrative future of cannabis payments. So when the government finally says “go,” they will be first out of the gate.

But for the time being, compliant cannabis payment processing solutions comprise only a handful of companies like Spence – or cash.

Need Help Navigating the New World of Cannabis Payment Solutions?

If you are new to the cannabis industry, or are among the veteran dispensary owners trying to adapt to the changing payment landscape and the labyrinth of local laws, springbig is here for you. We specialize in compliant marketing solutions for the cannabis industry.

We can also help you craft the best customer loyalty program, manage your customer data, and nurture long-term customer relationships.

And now with our new partnership with Spence, we can ensure that you avoid any hiccups in your payment infrastructure. That’s good news for your bottom line.

Don’t risk losing transactions to noncompliant payment solutions. Contact us today.